Professor Tomaso Aste from The UCL Centre for Blockchain Technologies shares his perspective on the use of blockchain technologies for both automatic regulation and compliance

Blockchain technologies have the potential to radically change compliance and regulation improving efficiency, reliability and transparency whilst redefining the services industry landscape generating new business models and radically innovating the present industry structure.

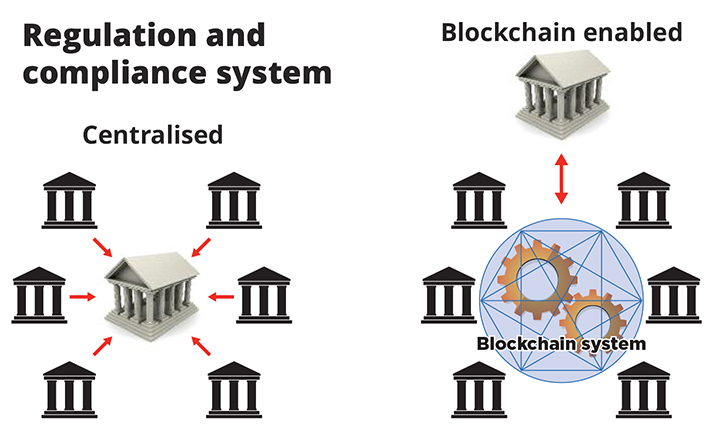

In the heavily-regulated financial sector, each financial institution maintains its own records on its own ledger system and reports data to the regulatory authorities accordingly with compliance rules. Over the whole market, this creates large duplication of efforts, lack of transparency and, unavoidably, inconsistencies that can cause litigations. These duplications and inconsistencies are associated with large costs and risks making the system inefficient.

Blockchain technologies can provide a transparent and secure environment where transaction records are made accessible to both industry and regulators. Through blockchain technologies and smart contracts, regulation and compliance can be automatised, thus removing strains from both regulators and industry while activating paths for new business models.

Blockchain technologies can reverse the way regulation and compliance are presently performed, creating an environment where both market players and regulators have access to trusted auditable data relieving firms from compliance duties and compliance risks (see Fig.1). Blockchain technologies bring about the following main elements of disruptive innovation:

Access to auditable data which are verified and hard to tamper with, creating time-stamped, immutable and historical records;

Constitution of a transparent, inter-operable environment where rules can be implemented, enforced and adapted by monitoring their effects in real-time and by using feedback from the participants;

Provision of instruments to monitor and quantify both the reliability and reputation of users;

Creation of a platform where rules can be encoded within the system – enabling automated review via audit software and;

Create a unique source of truth approved by the community via consensus.

Furthermore, blockchain technologies can reduce counterparty risk, settlement risk and help to prevent fraud. They have potential to radically change risk management and fraud prevention with implications for regulation and capital allocation. Blockchain technologies have the potential to bridge the trade-off between a regulation that guarantees market stability and a regulation that boost financial innovation. This convergence of industry and government interests is unique and as such, opens great opportunities. To this end, at a time when the financial sector is seriously investing in the development of these technologies, it is essential to develop an adequate research infrastructure to investigate the adaptation of blockchain technologies to regulation and compliance.

The general purpose of financial regulation is to forestall or alleviate the effects of market failure and promote innovations beneficial to public welfare. However, the ability of financial regulation to foster innovation in the services sector and financial sector, in particular, is challenged by the financial community that sees regulatory duties as detrimental to desirable change1. The Financial Conduct Authority, the Bank of England and their counterparts around the world face two linked transformative trends. One trend is the growth in the number of financial technology (FinTech) firms utilising cutting-edge technologies to offer innovative services. The other trend is the prospect of using some of those same technologies to better extract and analyse firm and market information to enhance regulation, making it more efficient (RegTech).

FinTech firms are hard to monitor by means of traditional instruments. FinTech population is fast-growing: in 2017 the FCA has regulated around 60,000 financial services firms and markets, about twice the number regulated in 2013. A growing number of these services providers are new small firms that use cutting-edge technologies exploiting innovative business models. Given these proliferating number of platforms and interfaces, there is a clear and present danger that, without proper regulation, consumer risk and fair competition will be imperilled.2

In addition, the financial crisis increased regulatory complexity and heightened levels of supervision and, correspondingly, increased costs for both regulatory authorities and regulated firms, including both incumbents and FinTechs. Automation in regulation and compliance can increase efficiency and decrease costs. Blockchain technologies can be the vehicle for such an innovation providing elements of transparency auditability and usability, by both regulators and industry that other systems cannot offer.

All industries and services are under some sort of regulation and they need to comply by reporting information to the relevant authorities and government bodies. The services sector contributes to 80% of the entire UK economy3, with the financial sector alone contributing £129 billion/year and the FinTech part generating over £20 billion in revenue every year, making the UK the world leader of the sector4. Automation in this sector will have a major economic impact on the economic prosperity of the UK.

In addition, although Blockchain technologies have been pioneered by the financial services industry, they have the potential for an even greater impact on government. Indeed, blockchain technologies can create trusted, safe records of agreements and transactions and therefore applications for government are widespread. For instance, blockchain technologies can provide access to tamper-proof public records such as licenses, vehicle registration, passports or building permits and official records such as land titles, patents, certificates, degrees or HR records.

The use of blockchain technologies in the services industry and for the purpose of their regulation poses fundamental scientific and technological challenges. It rises also legal/regulatory and business challenges because players are asked to do a paradigm shift from trusting humans to trusting machines and from centralised to decentralised control. These new challenges demand an in-depth study of feasibility to test the soundness and applicability of ideas and approaches. There are indeed several open questions concerning how blockchain technologies can be used to develop better instruments to regulate services industry.

For instance, can blockchain technologies be scaled to the speed and size of financial data while preserving fundamental properties, such as community distributed verification and consensus? What is an effective model of governance of blockchain technologies systems that guarantees protection to consumers and fair competition? What are the legal implications for code misbehaviour? (Some codes might even be automatically generated within a distributed unsupervised system). And who will regulate/supervise the regulatory codes? Can blockchain technologies be made future-proof to preserve integrity and privacy, even when historic information stratifies and if some cryptography protections get broken in the future? These issues are currently investigated at the UCL Centre for blockchain technologies and within the EPSRC-funded project BARAC (see boxes).

1 Bank Governance Leadership Network, View Point, ‘Accelerating the technological transformation of banking’ EY June 2016, http://www.ey.com/Publication/vwLUAssets/ey-accelerating-bankings-technological-transformation /$FILE/ey-accelerating-bankings-technological-transformation.pdf.

2 EBA. Warning to Consumers on Virtual Currencies. European Banking Authority, EBA/WRG/2013/01, 2013.

3 Financial Times 31 March 2016 https://next.ft.com/content/2ce78f36-ed2e-11e5-888e-2eadd5fbc4a4.

4 FinTech Futures: the UK as a world leader in Financial Technologies, a report of the UK Government Chief Scientific Advisor, 18th March 2015, https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/413095/gs-15-3-Fintech-futures.pdf.

BOXES:

CBT

The UCL Centre for Blockchain Technologies (CBT) is a cross-disciplinary academic research centre established at UCL in 2016 to investigate blockchain technologies from a cross-disciplinary perspective. CBT research is based on three main pillars: Science & technology, economic & finance and regulation & law. It counts on the support of eight UCL departments, about 100 researchers and faculty members, fellows from all over the world and a large student community which counts about 600 units.

For further information: http://blockchain.cs.ucl.ac.uk/

BARAC

BARAC is a research project funded in 2017 by the Engineering and Physical Sciences Research Council. Researchers from UCL, London School of Economics, KCL and University of Reading with background in computer science, economics, mathematics, business and law investigate the feasibility of using blockchain technology for automating regulation and compliance producing a proof-of-concept platform and facilitating knowledge transfer, by means of a bottom-up cross-disciplinary approach developed, together with industry and regulators.

Please note: this is a commercial profile

Professor Tomaso Aste

UCL Computer Science Department &

UCL Centre for Blockchain Technologies

http://www.cs.ucl.ac.uk/staff/tomaso_aste/

http://blockchain.cs.ucl.ac.uk/

Editor's Recommended Articles

-

Must Read >> Blockchain insurance set to change the industry

-

Must Read >> Changing regulatory rules in financial institutions