In this final article in a mini-series of articles discussing recent macroeconomic research on the effects of taxation on the economy, Bernd Hayo, Professor at the University of Marburg focuses on the use of tax policy for stabilising business cycles

Reflecting the concerns about large variations in output and employment going back at least to John Maynard Keynes, many governments use fiscal policy with the aim of reducing business cycle fluctuations. Thus, fiscal policy is part of the macroeconomic stabilisation toolbox. The fiscal policy itself can be categorised into expenditure-based and tax-based measures. Here we are concerned with the latter. After the heyday of macroeconomic stabilisation policy in the 1960s and 1970s, policymakers made less use of fiscal policy as a business cycle stabilisation tool since the 1980s. For instance, a historical account of German tax legislation reveals that the government did not use activist fiscal policy at all between 1980 and 2007 (Uhl 2013). This changed after the 2007 financial crisis when fiscal policymakers in many countries implemented large business cycle stimulus packages.

An important question that arises in this context refers to the effectiveness of fiscal policy. It seems straightforward to estimate the impact of tax policy on the economy, as tax data are collected with a high degree of precision. Unfortunately, that is not so. An important empirical challenge for identifying the effectiveness of stabilisation policy is its endogenous variation, i.e. fiscal policy reacts to national income and national income reacts to fiscal policy. Thus, to estimate the ‘pure’ impact of fiscal policy, we need a variation that is unrelated to the business cycle, i.e. exogenous variation. For instance, variation in government revenue is endogenous, as the two main forms of taxes, income tax and value-added tax (VAT) depend positively on economic activity.

The problem of obtaining exogenous variation is a specific example of an ‘identification problem’, which is a general issue in many fields of empirical economics. Two approaches are commonly used to overcome the identification problem in the present context: In structural vector autoregressions, one attempts to find an economic model that allows removing the influence of the business cycle through the model itself. In the natural experiments approach, one uses exogenous variations in government revenues, caused, for example, by wars, or changes in tax legislation unrelated to the business cycle.

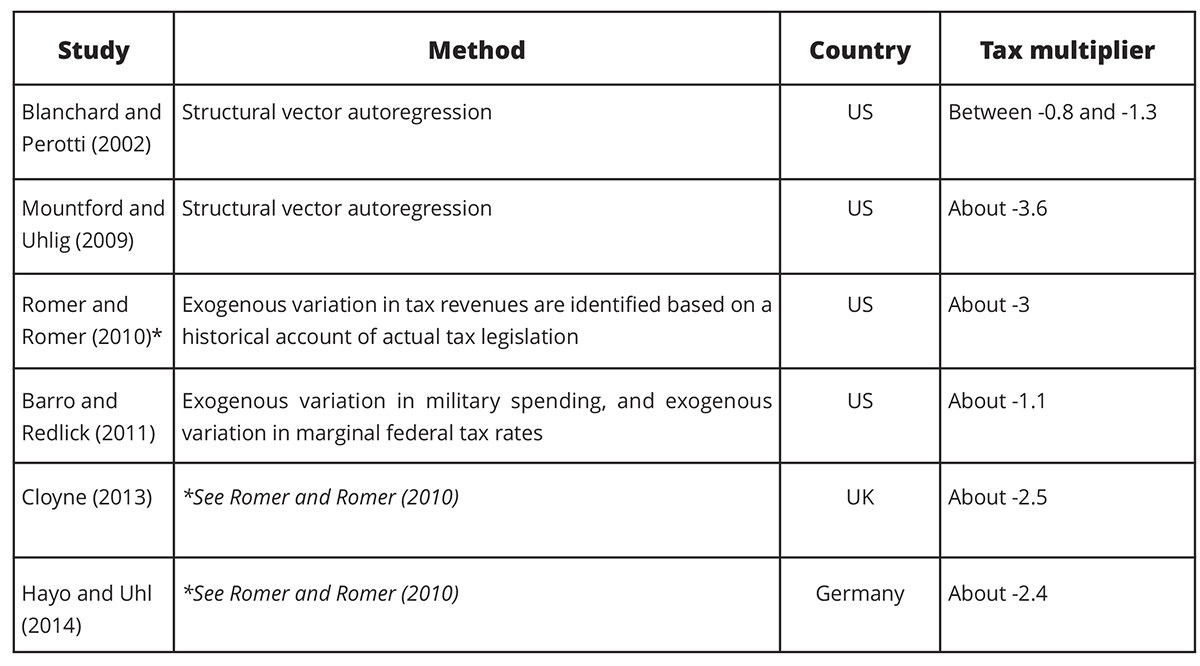

In Table 1, we list a selection of studies estimating ‘tax multipliers’, i.e. the effect of changing taxes by one unit on national income. Using different empirical methodologies and data, the selected studies concentrate on three countries, the US, the UK, and Germany. Focussing on the US and different estimation methods, we can see some variation, roughly ranging from -1 to -3. The comparison of the Romer and Romer (2010) method applied to different countries suggests a multiplier effect of about – 2.5, i.e. decreasing taxes exogenously by €1 (pound or dollar) raises national income by €2.5 (pounds or dollars). Thus, according to these results, tax policy appears to be a highly effective tool for business cycle stabilisation.

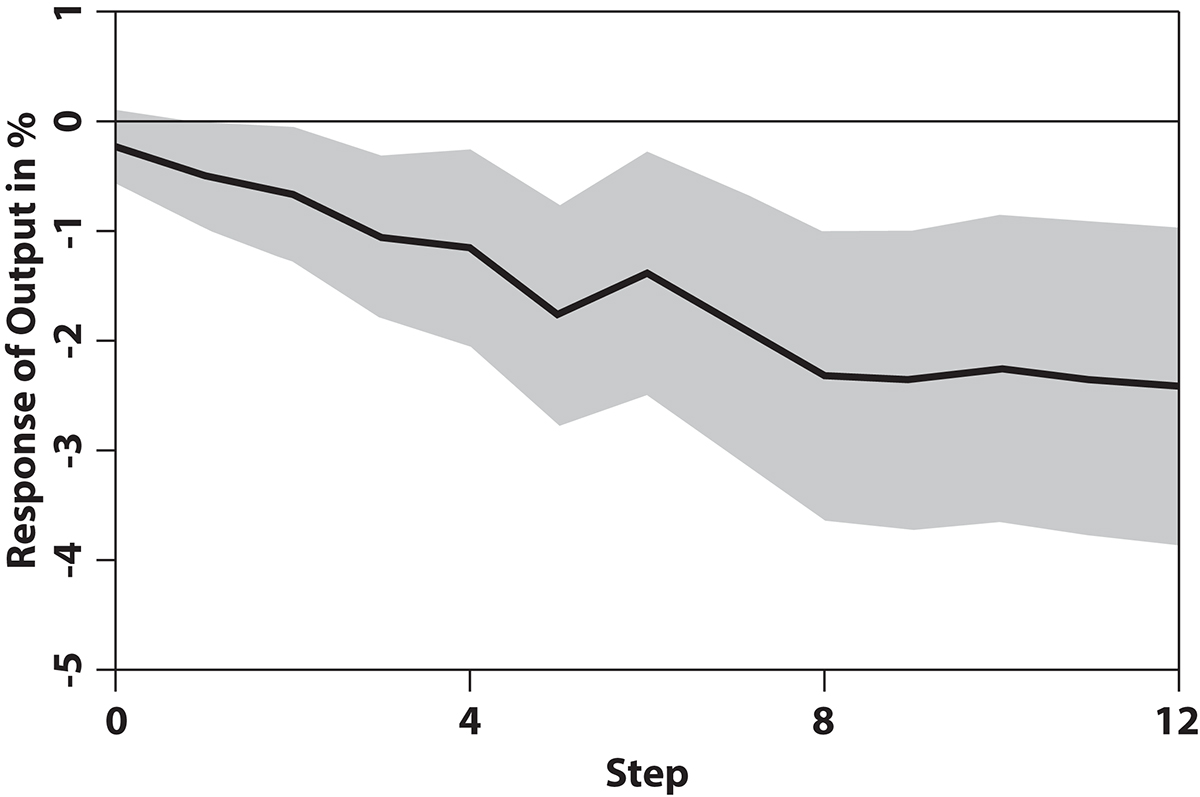

However, as can be seen from the values given for the US, even the point estimates reflect a notable degree of uncertainty. This uncertainty is actually even greater when considering the (lack of) precision of the point estimates. Taking the results by Hayo and Uhl (2014) for Germany as an example, Figure 1 provides the dynamic adjustment of income to a tax shock over time.

The grey area reflects the uncertainty surrounding the estimates, as with a probability of about 70% the actual values fall within that area. Concentrating on the effect after three years (12 quarters), we can see that with a probability of 70% the actual tax multiplier for Germany is roughly between -0.5 and -4%. With a probability of 30%, it falls outside of that range.

To summarise, statistical work on the effectiveness of tax changes as a stabilisation tool suggests that this form of fiscal policy is highly effective, with multipliers ranging between -1 and -3. However, in practice, the uncertainty surrounding the estimates is quite high and policymakers should be aware that the actual effects may differ substantially from those numbers.

References

Barro, R. J. and C. J. Redlick (2011), Macroeconomic Effects from Government Purchases and Taxes, Quarterly Journal of Economics 126, 51-102.

Blanchard, O. and R. Perotti (2002), An Empirical Characterization of the Dynamic Effects of Changes in Government Spending and Taxes on Output, Quarterly Journal of Economics 117, 1329−1368.

Cloyne, J. (2013), Discretionary Tax Changes and the Macroeconomy: New Narrative Evidence from the United Kingdom, American Economic Review 103, 1507-1528.

Hayo, B. and M. Uhl (2014), The Macroeconomic Effects of Legislated Tax Changes in Germany, Oxford Economic Papers 66, 397-418.

Mountford, A. and H. Uhlig (2009), What are the Effects of Fiscal Policy Shocks? Journal of Applied Econometrics 24, 960-992.

Romer, C. D. and D. H. Romer (2010), The Macroeconomic Effects of Tax Changes: Estimates Based on a New Measure of Fiscal Shocks, American Economic Review 100, 763–801.

Uhl, M. (2013), A History of Tax Legislation in the Federal Republic of Germany, MAGKS Discussion Paper 11-2013, Marburg.

Please note: This is a commercial profile