Bingsheng Zhang from Lancaster University reveals how a treasury system will enable a better collaborative intelligence for cryptocurrencies

Blockchain technology has pioneered a new consensus approach to build a distributed public ledger globally. One of the key features expected from cryptocurrencies and blockchain systems is the absence of a centralised control over the operation process. That is, blockchain solutions should neither rely on “trusted parties or powerful minority” for their operations nor introduce such centralisation tendencies into blockchain systems.

On the other hand, real-world blockchain systems require steady funding for the continuous development and maintenance. Given that blockchain systems are decentralised, their maintenance and developmental funding should also be void of centralisation risks. Therefore, secure and “community-inclusive” long-term sustainability of funding is critical for the health of blockchain platforms.

During the early years, the development of cryptocurrencies, such as Bitcoin, mainly relies on patron organisations and donations. Recently, an increasing number of cryptocurrencies are funded through initial coin offering (ICO) – a popular crowd-funding mechanism to raise money for the corresponding start-ups or companies. A major drawback of donations and ICOs is that they lack sustainable funding supply. Consequently, they are not suitable as long-term funding sources for cryptocurrency development due to the difficulty of predicting the amount of funds needed (or that will be available) for future development and maintenance.

Alternatively, some cryptocurrency companies, such as Zcash Electric Coin Company, take a certain percentage of hair-cut/tax (a.k.a. founders reward) from the miners’ reward. This approach would provide the companies with a more sustainable funding source for long-term planning of the cryptocurrency development.

Nevertheless, all the aforementioned development funding approaches have risks of centralisation in terms of the decision-making on the development steering. Only a few people participate in the decision-making process on how the available funds will be used. However, the decentralised architecture of blockchain technologies makes it inappropriate to have a centralised control of the funding for secure development processes. Sometimes disagreement among the organisation members may lead to catastrophic consequences.

Ideally, all the cryptocurrency stakeholders are entitled to participate in the decision-making process on funding allocation. This democratic type of community-inclusive decentralised decision-making enables a better collaborative intelligence. The concept of the treasury system has been raised to address the highlighted issue. A treasury system is a community controlled and decentralised collaborative decision-making mechanism for sustainable funding of the underlying blockchain development and maintenance.

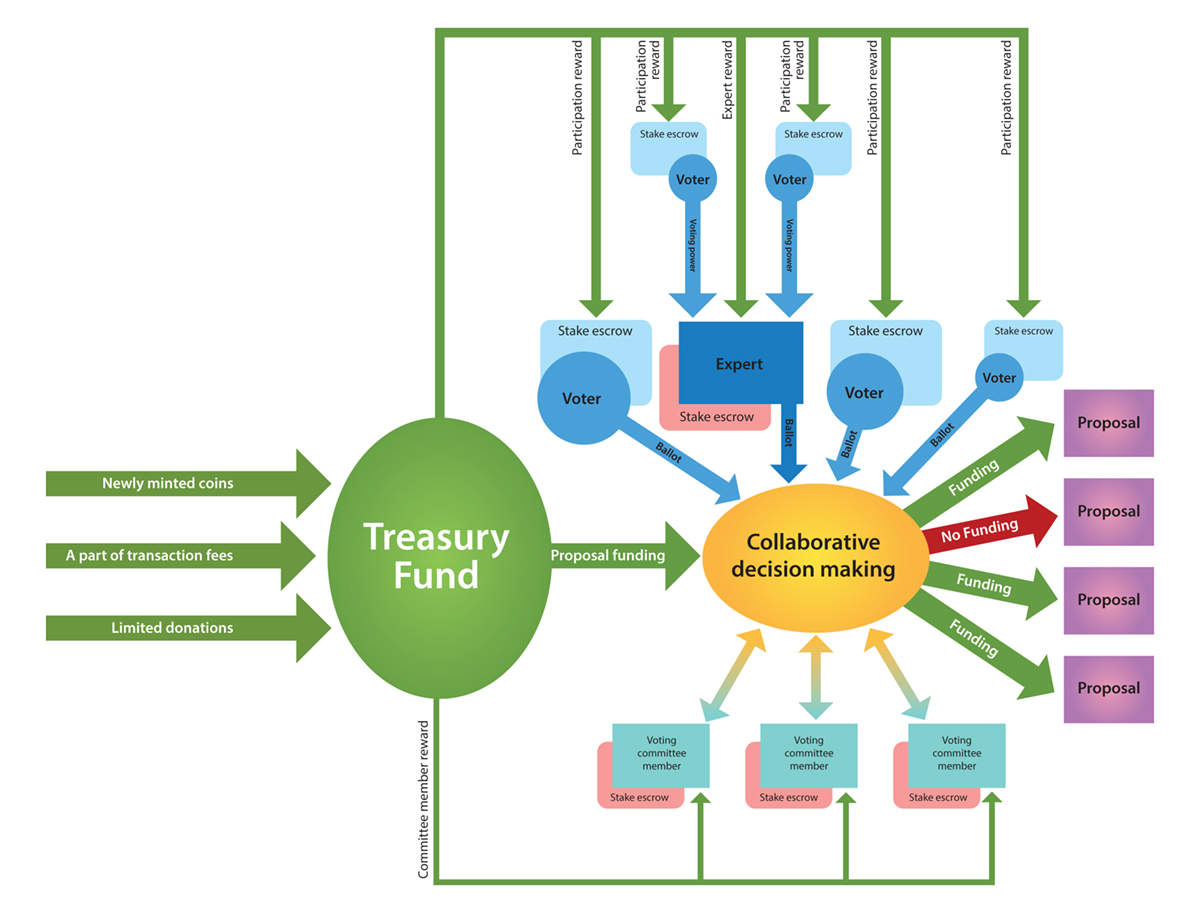

At Lancaster University, the research team led by Dr Bingsheng Zhang has been actively developing a novel treasury system for blockchain in collaboration with IOHK. This project aims to resolve the funding sustainability issue for long-term cryptocurrency development and maintenance. Figure 1 illustrates an overview of the treasury system and it consists of iterative treasury periods.

During each treasury period, project proposals are submitted, discussed and voted for; top-ranked projects are then funded. In particular, Lancaster research team has developed the world’s first universally composable provably secure distributed decision-making system that supports liquid democracy with privacy assurance – to achieve better collaborative intelligence.

Liquid democracy (also known as delegative democracy) is a hybrid of direct democracy and representative democracy. It provides the benefits of both systems (whilst doing away with their drawbacks) by enabling organisations to take advantage of experts in a treasury voting process, as well as giving the stakeholders the opportunity to vote. For each project, a voter can either vote directly or delegate his/her voting power to an expert who is knowledgeable and renowned in the corresponding area.

The proposed treasury system is compatible with most existing off-the-shelf cryptocurrencies/blockchain platforms, such as Bitcoin and Ethereum. The system is self-sustainable, robust, private and end-to-end verifiable. Any stakeholder in the community can participate in the treasury voting and their voting power are proportional to their possessed stake. The system collects funding via three potential sources: (i) Minting new coins, (ii) Taxation from Miners’ reward, (iii) Donations or charity.

In this proposed system, coin ownership is distinguished from stake ownership. That is, the owner of a coin can be different from the owner of the coin’s stake. This allows blockchain-level stake delegation without transferring the ownership of the coin. It means that the user can delegate his/her stake to someone else without risk of losing the ultimate control of the coin(s). To achieve this, we introduced a stake ownership verification mechanism using the payload of a coin.

We also provide prototype implementation of the proposed treasury system for running and benchmarking in the real world environment. Our implementation is written in Scala programming language over Scorex 2.0 framework. It is fully decentralised and resilient up to 50% of malicious or faulty participants.

Please note: this is a commercial profile

Bingsheng Zhang, PhD

Program Director of Msc. Cyber Security

Security Lancaster

Lancaster University